Managing investments in today's volatile crypto market can be challenging for even experienced investors.

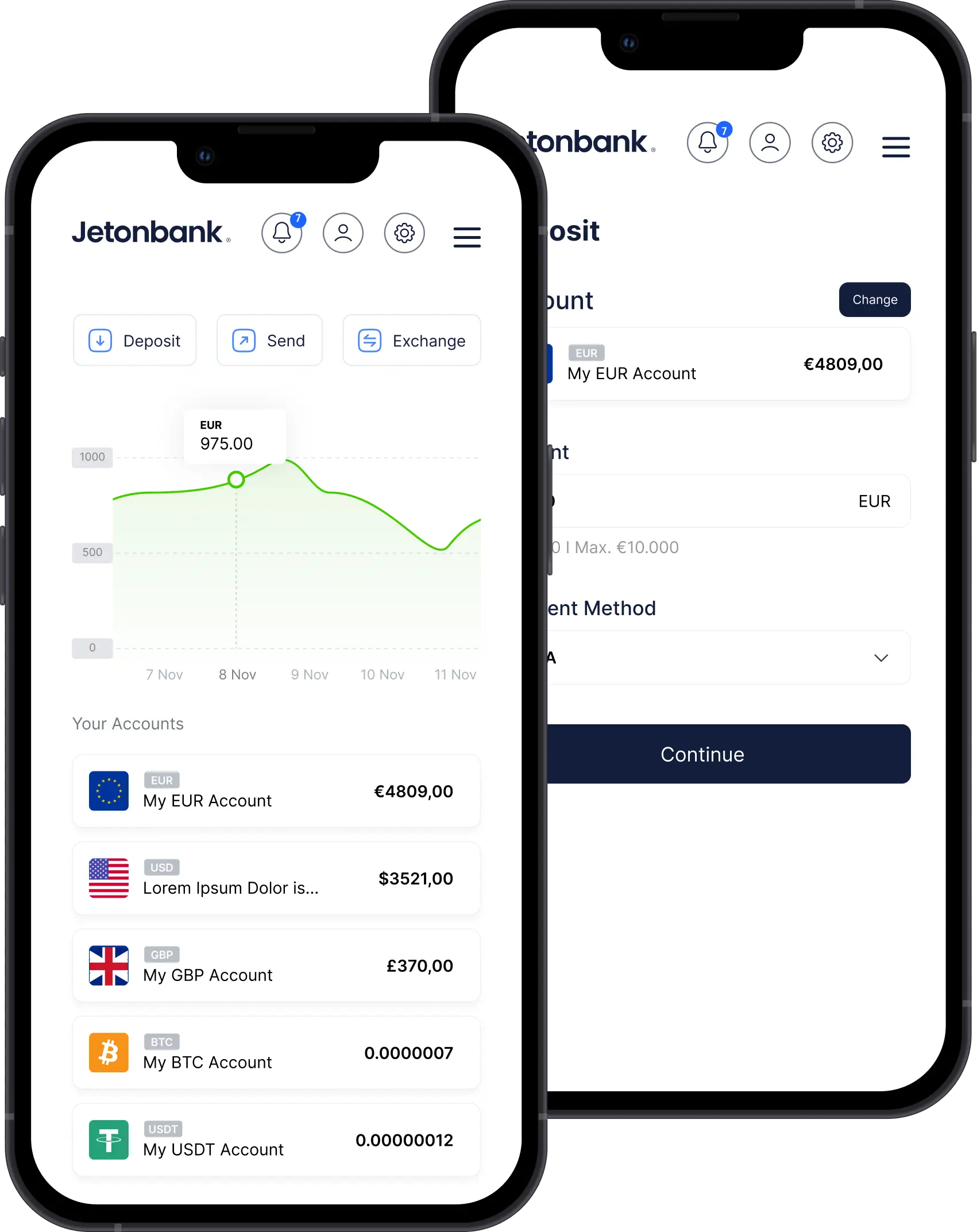

With so many digital assets to choose from and prices fluctuating constantly, it helps to have a crypto friendly bank that understands the needs of international crypto market participants.

In this article, we will explore how crypto market analysis can help investors better navigate opportunities and risks, as well as the perks of banking with Jetonbank.

How to Make Crypto Investments?

Successful crypto investing starts with research and analysis of market conditions.

While past performance does not guarantee future results, crypto market analysis provides valuable insights into demand drivers, trends, and overall market sentiment.

Some tips for conducting analysis include:

- Monitor trade volume and volatility. Spikes could indicate renewed interest while periods of low volatility present opportune entry points.

- Track mentions on social media. Platforms like Twitter give a real-time read on which coins are gaining attention.

- Follow developments in the crypto space. Big announcements from industry players can catalyze price swings in relevant assets.

- Study global market trends. As cryptos become more correlated with risk-on/risk-off environments, it pays to watch traditional markets too.

Armed with this contextual information, investors can identify coins with the most convincing short and long-term outlooks.

A crypto friendly bank like Jetonbank that supports a variety of digital assets then makes executing the resulting investment decisions seamless.

Can Savings Be Made With a Crypto Account?

In addition to facilitating investment moves, a flagship service offered by Jetonbank is generating yield on digital asset holdings through lending and staking programs.

Certain Proof-of-Stake blockchains reward users for "locking up" their coins to validate transactions, and Jetonbank passes on these rewards to depositors.

For example, staking the Ethereum currency Ether historically yielded an annual percentage rate (APR) of 4-7%. With a six-figure Ether stack, that passive income stream could amount to serious savings.

Jetonbank further broadens these possibilities by partaking in crypto-collateralized loans where deposits are borrowed by traders and repaid with interest.

While not risk-free given crypto volatility, these programs introduce attractive new dimensions to portfolio management. They allow users to generate ongoing yield from “idle” digital assets rather than watch them stagnate in a hot wallet.

For anyone serious about the crypto market, the benefits of operating through a trusted crypto bank become clear.

What are the Benefits of Crypto Market Analysis?

Why should investors bother with crypto market analysis? The primary benefits include:

Identifying opportunities early:

Analysis spots developments before they move prices, like promising projects raising VC rounds. Getting positioned in advance maximizes upside.

Managing risk through knowledge:

Knowing your investments’ macroeconomic sensitivities and technical factors helps time entries and exits more prudently. Charts become less mystifying.

Achieving a competitive edge:

Markets are unpredictable, but staying informed places analytically-minded traders at an advantage versus relying on luck alone. Solid research habits breed success over the long haul.

Informing portfolio construction:

Understanding correlations between assets allows building a more resilient mixed bag with less concentration risk. Analysis helps avoid overexposure.

Honing estimation abilities:

Crypto still surprises, but study gradually enhances one’s ability to foresee bull and bear cycles. Assets behave according to discernable patterns over time.

In volatile domains like digital finance, taking a scientific and disciplined approach smooths the bumps of the rollercoaster ride. A bank like Jetonbank that values analysis as much as its clients complements this philosophy nicely.

Contributions of Crypto Market Analysis to Your Investment

Making consistently profitable investments in any market requires focus, diligence and leveraging every available edge. Crypto market analysis cultivates precisely those qualities in several notable ways:

- Risk Management - By comprehending volatility drivers, volatility cycles and macro factors that influence prices, analyze arms traders to implement prudent risk controls through position sizing, stopping out or taking partial profits as conditions warrant.

- Idea Generation - Scanning social media sentiment, project roadmaps, exchange flows and more reveals emerging narratives before peers catch on. Analysts profit from ideas in earlier stages.

- Portfolio Diversification - Recognizing co-movement between digital assets helps spread holdings across weakly-correlated categories for improved risk-adjusted returns versus putting all eggs in one basket.

- Disciplined Process - Research imbues investing with structure, separating decisions from fleeting emotions. Sticking to a repeatable methodology produces longevity while emotions drain accounts quickly in crypto.

- Competitive Advantage - In reality, markets evolve based on the aggregate behavior of all players. Gaining unique color on this "aggregate" grants an informational leg up over the investing masses.

Working with a crypto-friendly bank like Jetonbank amplifies these profits, enabling sophisticated portfolio construction and execution strategies across a wide spectrum of digital currencies and platforms. Our analytical mindset creates optimal conditions for long-term growth.

Crypto Market Analysis Tips

Some tips for effectively analyzing the crypto market include:

- Follow multiple time frames - Markets display diverse patterns over short, medium and long durations. No single interval provides a full picture.

- Blot biased views - Remain agnostic to "hopes" for coins and base ideas purely on objective signals from metrics like order flow.

- Automate routine tasks - Technical indicators consolidate reams of price data. Proper programming frees up brainpower for higher-level tasks.

- Document everything - Keep organized notes mapping strategies to outcomes for retrospective review. Over time, weaker methods become apparent.

- Collaborate, don't compete - Exchange findings with a network to crowdsource perspectives. Two heads really are better than one in this pursuit.

- Remain flexible - Successful analysis leads to evolving viewpoints. Clinging rigidly to proven losers correlates with subpar performance long-run.

By making analysis a collaborative, evidence-based routine upheld by the appropriate institutional support framework, investors maximize chances of intelligently profiting from the boundless potential of digital currencies. Jetonbank checks all the right boxes.

While the opaque and volatile crypto market intimidates some, others see opportunity. Those taking a systematic analytical approach supported by a leading player like Jetonbank gain clear benefits.

With research cultivating risk management abilities, idea generation and informed portfolio construction, analysis becomes the cornerstone of enduring success stories in this innovative sector. Jetonbank's tailored services and progressive vision further empower clients to optimize results from crypto finance on a global scale.

Our support for a diversity of digital assets and strategies represents the future of this burgeoning industry.