In today's digital world, more and more people are turning to online banking solutions to manage their finances.

While traditional ‘brick and mortar’ banks still have their place, digital private banking offers numerous advantages for those seeking a more personalized approach tailored to their needs.

In this article, we'll explore the primary benefits of opening a private banking account with a digital bank like Jetonbank.

What are the Primary Benefits of a Private Banking Account in Digital Banking?

One of the biggest draws of private banking accounts is the personalized financial advice and expertise you have access to. With a traditional bank account, you're largely on your own to manage your money and investments.

However, private banking pairs you with dedicated professionals who have extensive knowledge in wealth management.

Your personal account manager takes the time to understand your unique financial situation and goals. They can then provide customized recommendations and strategies.

For example, they may help you develop long-term investment plans, tax minimization strategies, trusts and estate planning, and more.

This level of customized service simply isn't available with regular consumer banking. Digital private banks like Jetonbank still offer this personalized touch even though interactions occur virtually instead of face-to-face.

Another key benefit is the exclusive products and services available only to private banking clients. This may include access to investment opportunities not publicly listed, preferred rates on loans and credit cards, concierge services, and other higher-end perks.

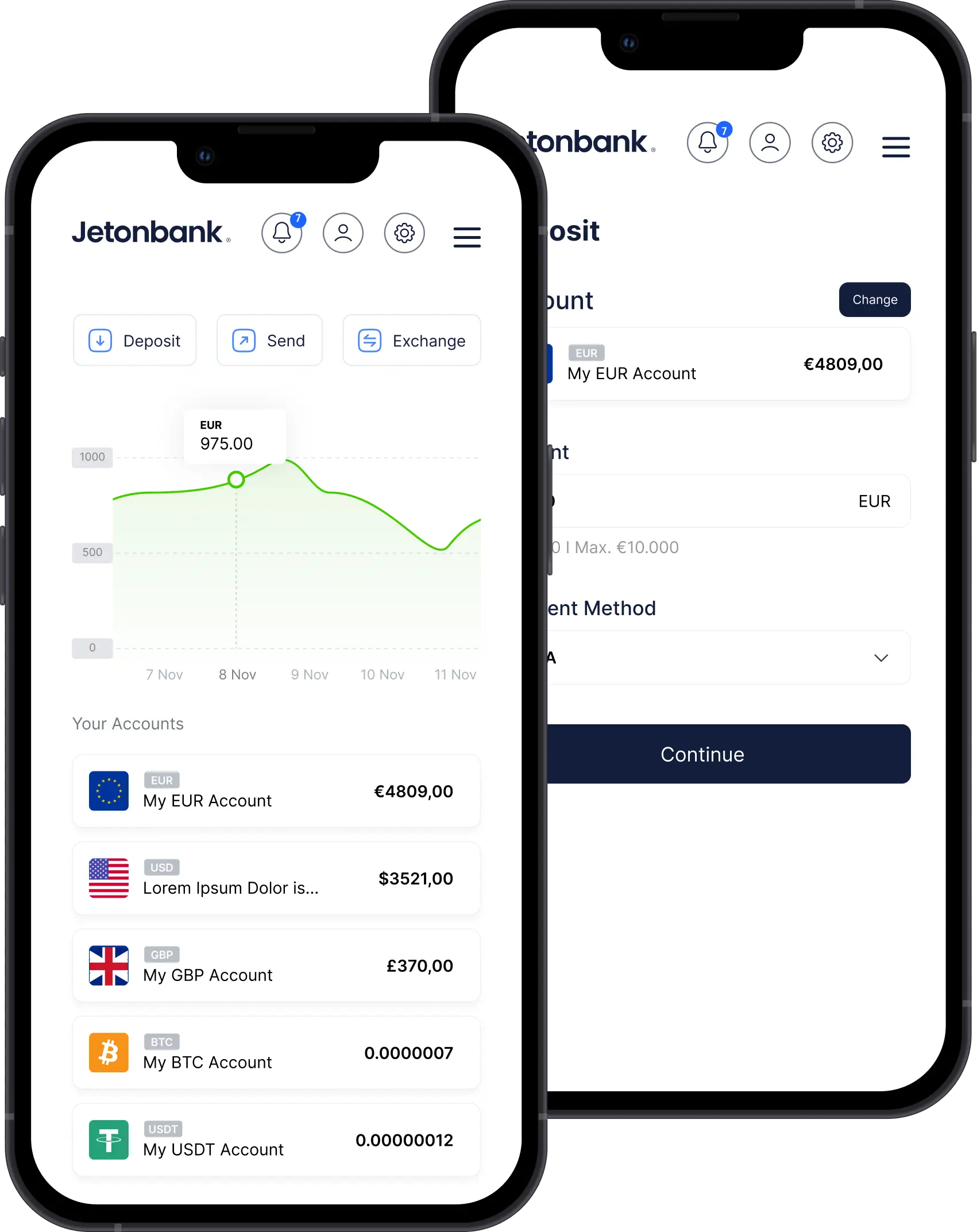

The wide array of digitized wealth management tools at your fingertips also streamlines money matters. With Jetonbank 's online platforms, you can holistically track investments, manage cash flow, and get a consolidated view of your financial life with just a few taps.

Can I Get Personalized Financial Advice with Digital Private Banking?

One of the hallmarks of private banking is access to personalized financial advice. Through digital channels, relationship managers can provide tailored recommendations suited precisely to your profile.

Your dedicated advisor takes the time to understand your complete financial picture, not just assets but also future goals, risk tolerance, and other personal factors.

They then craft bespoke plans around wealth preservation, tax optimization, estate planning, retirement strategies, and more.

Having a single point of contact through digital private banking ensures coherence across what can otherwise be a fragmented financial life. Your relationship manager acts as your concierge, overseeing your entire portfolio and coordinating with niche experts as needed.

Periodic review meetings allow you and your advisor to re-evaluate strategies and catch any changes early.

Digital tools make it simple to jointly examine key metrics, brainstorm ideas, and arrive at the best path together even when remote.

Digital private banking brings the benefits of personalized financial stewardship to your fingertips through ongoing remote guidance tailored specifically to your individual needs and objectives.

How Secure is a Digital Private Banking Account?

Naturally, security represents a primary concern when banking digitally instead of in-person. However, premier digital private banking platforms like Jetonbank take online security to the highest level.

Rigorous multi-factor authentication protocols like one-time passwords and biometric checks ensure only the legitimate account holder can access the system.

Savings and investments are backed by institutional-grade digital vaulting that utilizes military-level encryption, hardware segregation, and constant monitoring against threats.

Transactions only occur between authorized parties, and fund movement always requires additional security layers on top of logins. Personal details and financial information are strictly partitioned and never exposed externally.

Digital systems also undergo relentless penetration testing and auditing by independent cybersecurity experts. Any vulnerabilities are immediately addressed to stay ahead of emerging risks. Servers reside in certified secure facilities with redundant infrastructure and automatic geographic failover capabilities.

Customers can rest assured knowing their assets and privacy are as protected online as through traditional channels, with digital private banking leveraging cutting-edge technology rather than physical security theater.

When choosing a partner like Jetonbank, wealth is digitally guarded with the latest fortress-grade safeguards.

What are the Eligibility Requirements for Opening a Private Banking Account?

Private banking caters to select customers rather than the general public. There are typically minimum criteria to qualify, though digital private banks tend to be more accommodating than traditional institutions:

Net Worth - Most expect a minimum of $1 million in investable assets beyond primary residence. Some may set lower limits like $250,000 for digital account access.

Income - Annual salary or earnings of at least $150,000 on average over the last couple years is common.

Investment Experience - Some familiarity handling stock portfolios, funds, property, or businesses demonstrates financial sophistication.

Complex Needs - If you require specialty services like trust/estate planning, tax consulting, corporate loans, or access to private deals.

Residency - Reside or be employed in countries where the bank is licensed to provide cross-border services.

While the above guidelines apply, flexibility also exists. Qualified companies, family offices, non-profits, or inherited fortunes may quality based on specific circumstances.

The overall emphasis stays on financial pedigree and need for advanced wealth solutions rather than inflexible thresholds. Digital private banks in particular focus more on character than numbers.

Which Bank is the Best to Open a Private Bank Account Online?

When choosing where to open a private bank account digitally, experience, features, global reach, and security matter greatly.

On all these fronts, Jetonbank stands out as a premier option for global private digital banking needs.

As a fully licensed and regulated offshore private bank based in Dominica, Jetonbank provides a complete wealth of online and mobile services normally restricted to ultra-high net worth individuals.

Plus with no physical branches, we pass on substantial cost savings to customers through competitive interest rates and fees.

Client relationships are managed virtually through your dedicated personal banker, who is always on call via phone, chat, or video meetings. Jetonbank's proprietary digital portal centralizes global portfolio oversight and money movement across currencies and asset classes with just a few clicks.

World-class cybersecurity and banking-grade encryption protect identities and funds online as if transacting in the safety of a premier private bank lounge.

And with universal licensing, money can easily be accessed from any country on Earth where life may take you.

Jetonbank brings an unprecedented blending of elite offshore private banking capabilities with the frictionless user experience of modern FinTech.

Our full-spectrum digital solution earns the top spot among online-only private banking alternatives worldwide.

Digital private banking represents the future for sophisticated wealth management needs requiring cross-border solutions.

Platforms like Jetonbank powerfully combine the best of both private banking and online FinTech worlds through our exemplary global portal, security measures, personalized service models, and wider eligibility rules.

If you have qualified assets and require expert stewardship with flexibility of remotely accessing your sizable portfolio from anywhere, Jetonbank sets the gold standard for digital-first private wealth solutions.

Speak to an account manager today about opening your own private bank account with us to begin enjoying all the high-end advantages of wealth preservation made beautifully simple through modern online private banking.