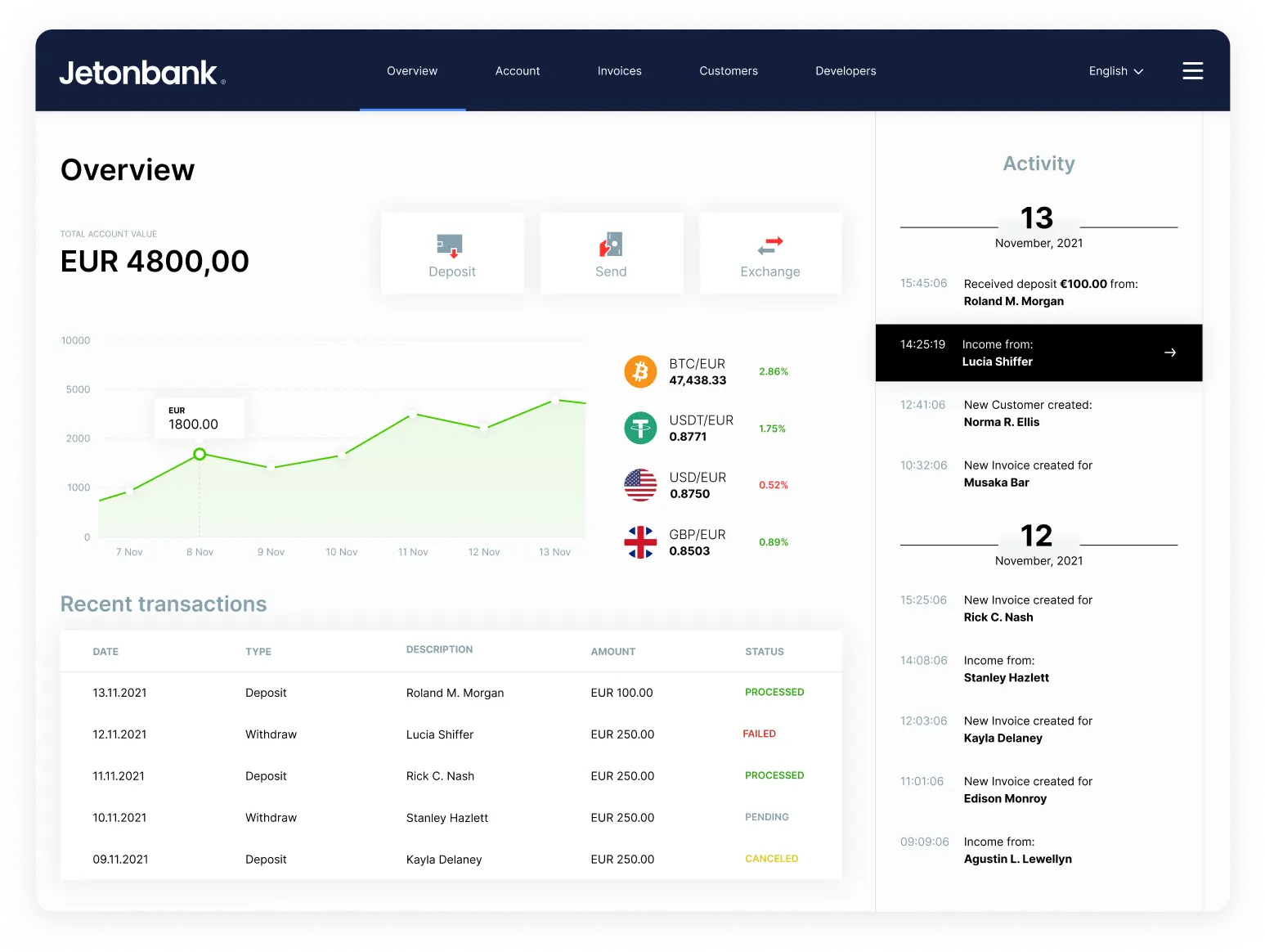

Get a dedicated SEPA IBAN account for your business

Schedule Now

Get a Euro IBAN for your company’s tradings

Creating a private IBAN account for your business in an ordinary bank may be more difficult and troublesome than you imagine. It is both a time consuming and a complex process.

This is where we step in as Jetonbank. We offer you the opportunity to make your Euro transactions by creating a completely secure and unique IBAN account. With your Euro IBAN account, which you can get online, you can perform all your trading without any problems.

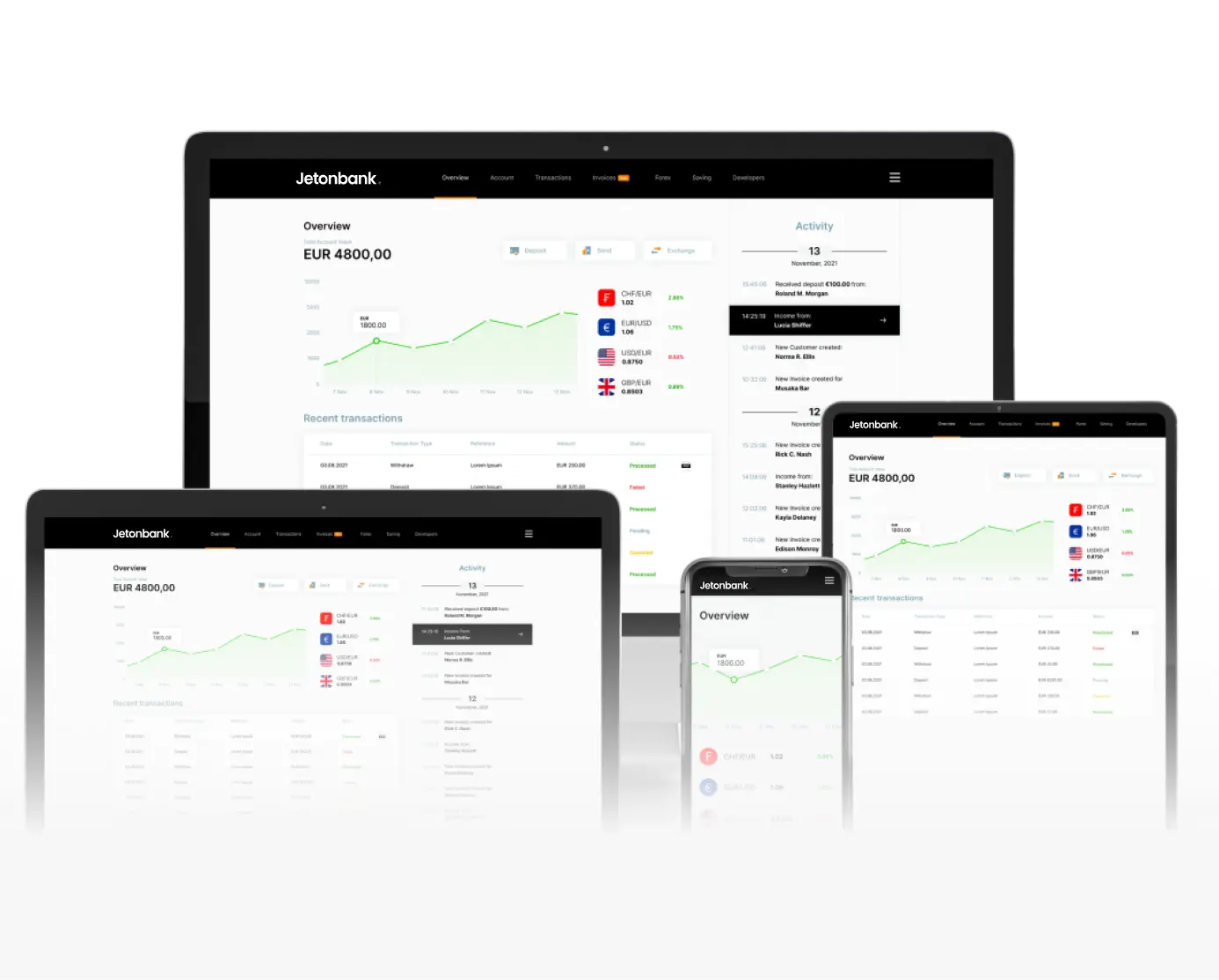

Discover your

advantages with

IBAN business

account

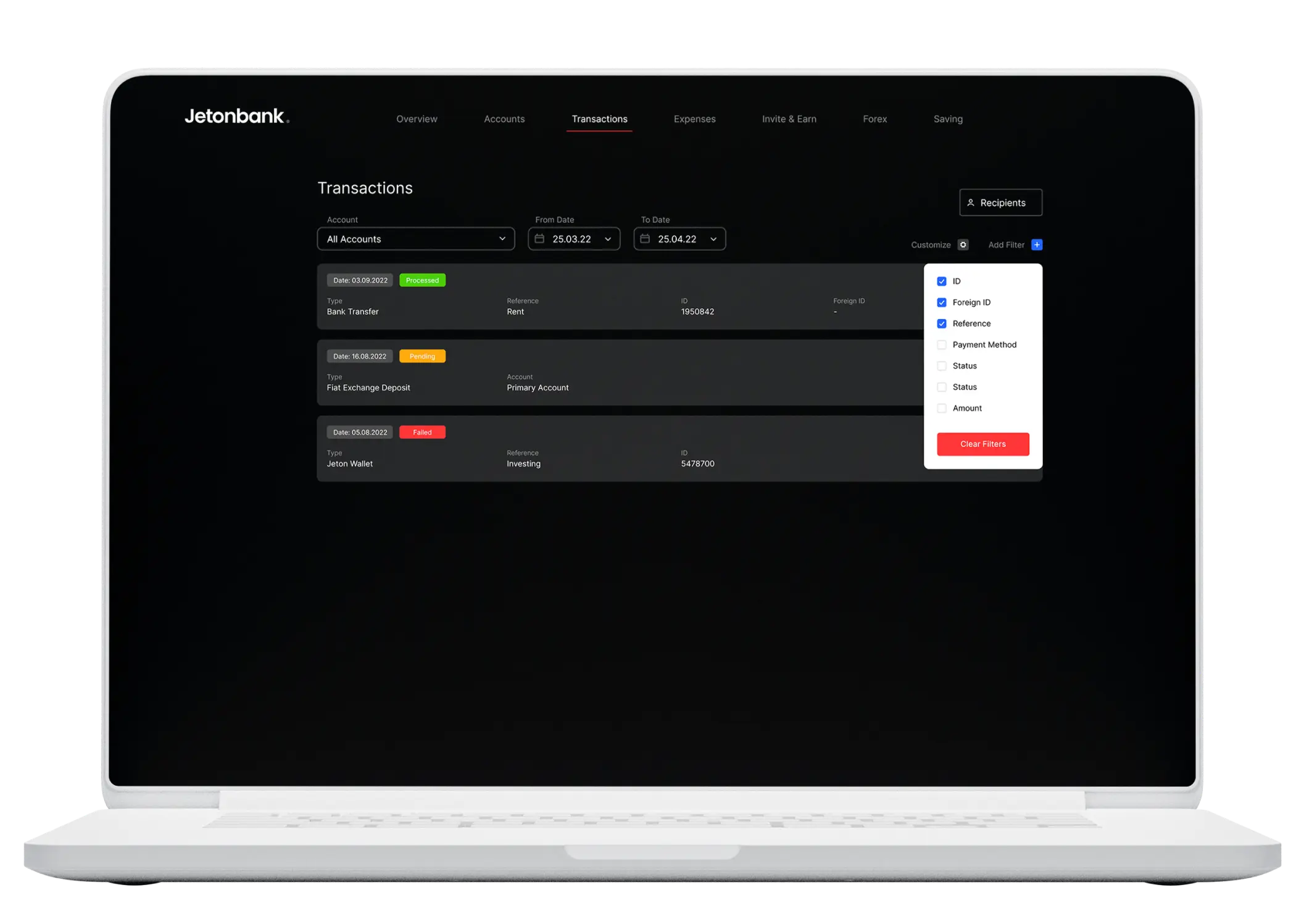

START SMALL, GROW WITH JETONBANK

Let’s grow your business

together in digital banking

Premium low fee Euro IBAN for Selected Businesses

Jetonbank makes your business easier with the low fee Euro IBAN account it offers to selected business owners. You can also create an account for detailed information about business account setup and pricing.

Additional Services

Check out the additional Jetonbank

services to grow in digital banking

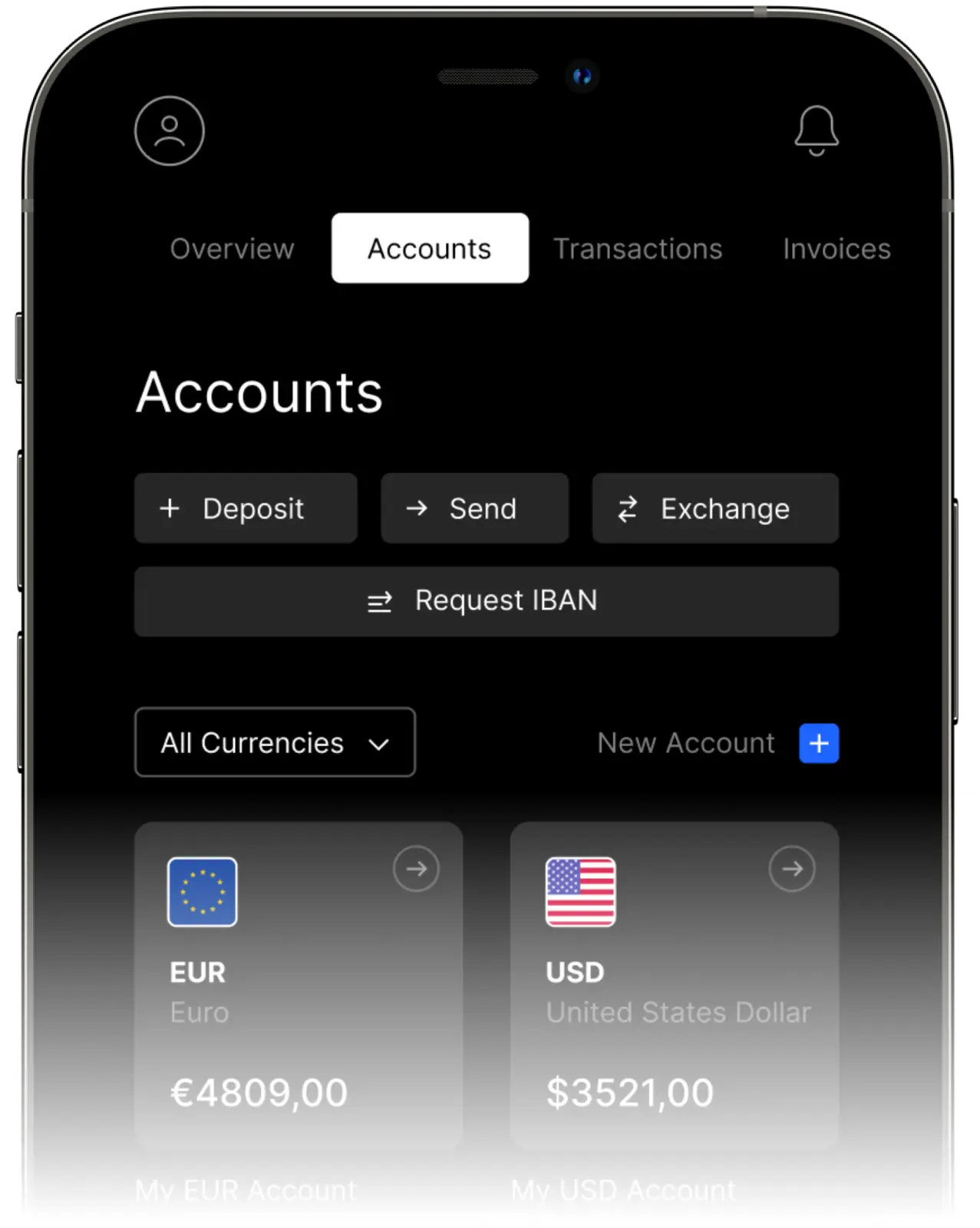

Transfers with EU SEPA

If you live in the Eurozone, this is a great service method of sending and receiving money that you can easily use in your daily life!

SWIFT Transfers Worldwide

You can schedule your SWIFT transfers to pay the same amount on a regular basis. Effortless and completely safe.

Transaction at any time with instant transfers!

Jetonbank users can send and receive money between themselves whenever they want. Also, you won't have any nasty surprises with no hidden fees. With the Custom Jetonbank link, you can invite your acquaintances to become users just like you!

How do I generate an IBAN?

Is the IBAN number unique for each account?

How to transfer money to an IBAN account?

What is the difference between IBAN and account number?

Grow your business with Jetonbank

All the banking transactions your business needs in a single account.

SIGN UP NOW →